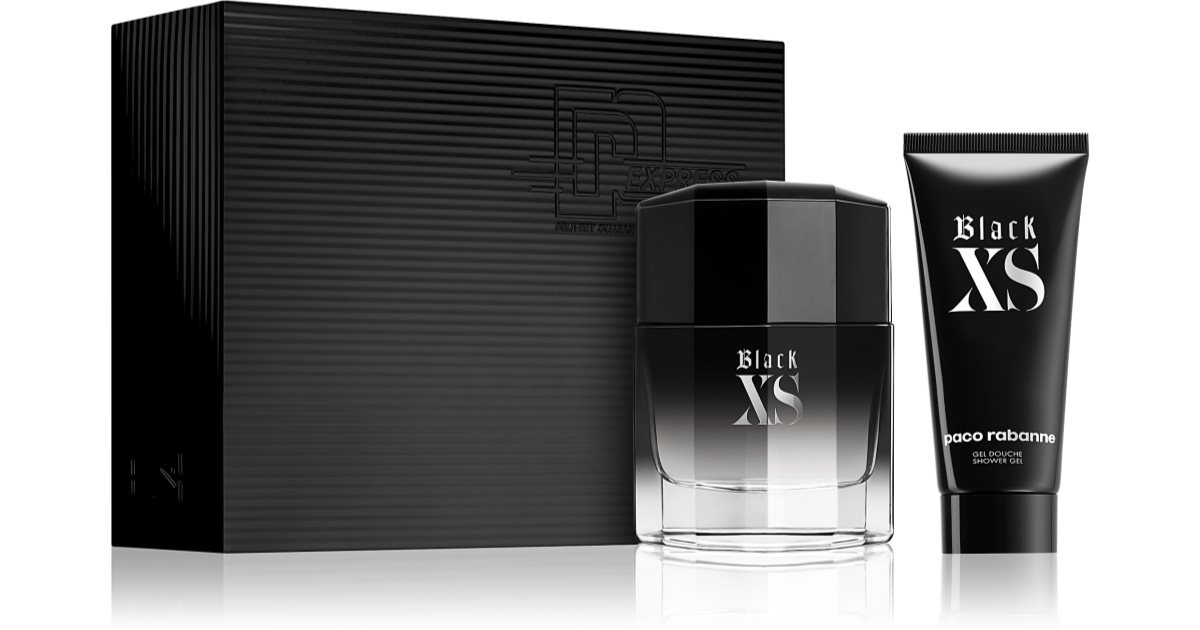

COFFRET PACO RABANNE Black Xs Eau De Toilette 100 Ml + 1 Vapo Voyage 10 Ml Neuf EUR 135,00 - PicClick FR

parfum : coffret paco rabanne black xs 100ml pour hommes à 34€ ( Sephora) - Bons Plans Bonnes Affaires

Concours Paco Rabanne Black XS, gagnez des coffrets collector Kings and Queens - Le blog d'Anne Thoumieux